WHAT WE OFFER

Vehicle Service Contract

Does your current VSC administrator disclose their administrative fee and how does this administrative fee impact your loss ratio?

The average VSC premium is $1,200. Industry average loss ratio: 50.1%. Who keeps the remaining 49.9% in your current relationship?

What happens to the funds intended to pay claims when a member’s claim is denied?

Does your credit union have a say in claim approvals/denials?

What does your penetration level compared to GAP tell you about your current VSC program?

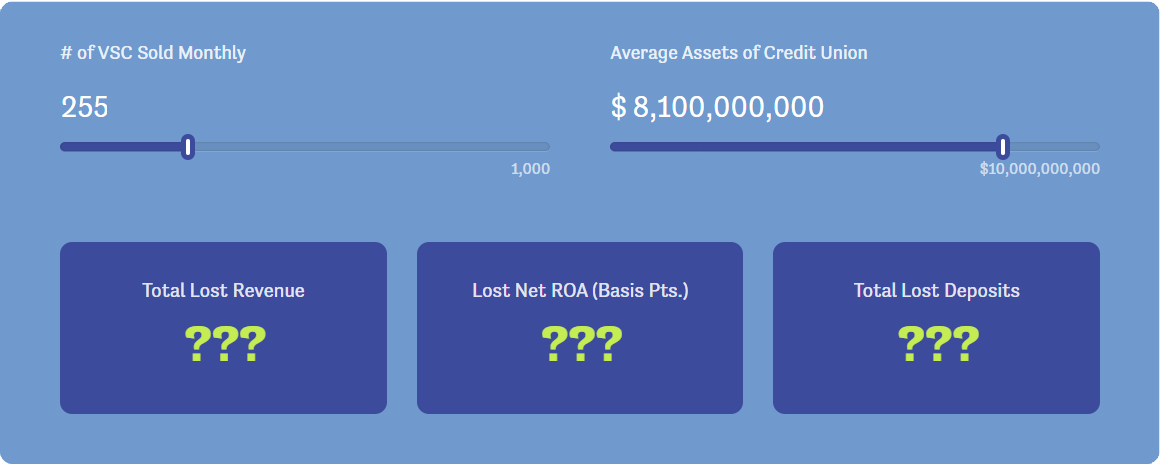

How much money did your Credit Union lose last year using your current VSC vendor?

Enter your information to find out:

Discover the Benefits

For Members

- Claims process controlled by the credit union covering more claims

- A true $0 deductible plan

- We offer Comprehensive Coverage and Benefits

- Our plan pays Full Retail rate on Parts & Labor

For Credit Unions

- A VSC that staff can be proud to offer

- 100% control of claims process

- 100% return of underwriting profits

- Claims not deducted from refunds

- Improved dealer relationships as credit union is now helping drive profits in the service department

- Can be offered through indirect dealerships

For Insurance CUSOs

- Commission structure based on credit union relationship

- Increased penetration from credit union lending staff training

- Credit unions manage to reduce staffing needs

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.